Global Market: Building a Domestic, Yet International Startup

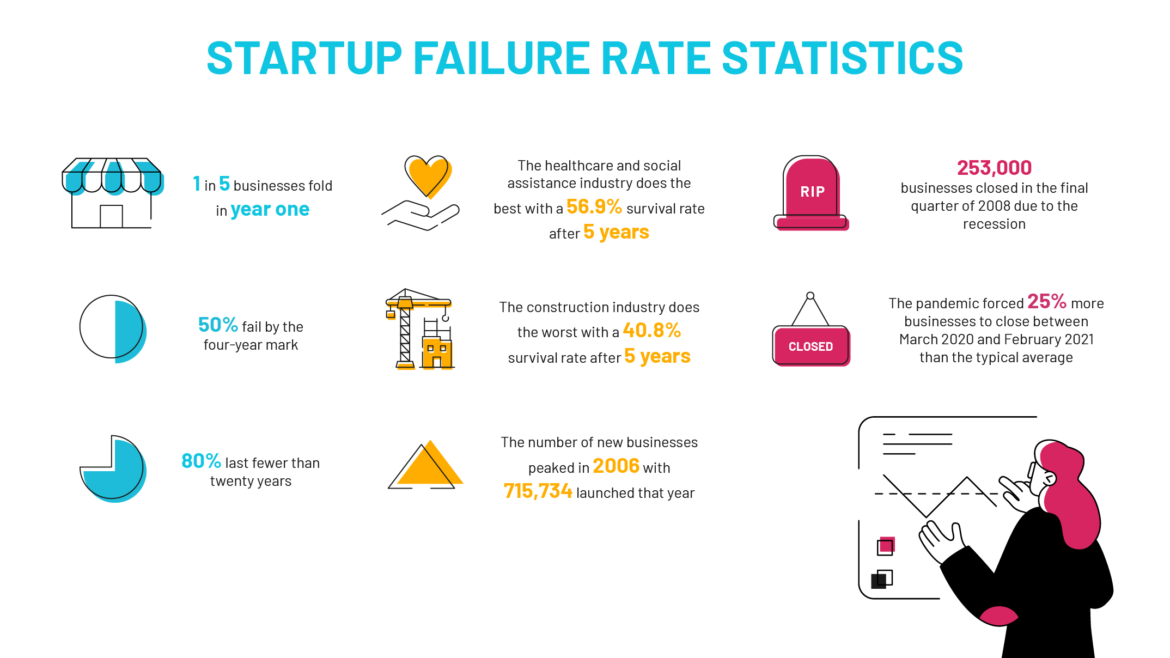

Global Market: Building a Domestic, Yet International Startup https://theraise.eu/wp-content/uploads/2024/05/international-business-1-1024x852.png 1024 852 RAISE fosters startup growth and scale-up within and across Europe https://theraise.eu/wp-content/uploads/2024/05/international-business-1-1024x852.pngIn today’s interconnected world, the traditional boundaries between domestic and international markets are becoming increasingly blurred. For startups, this presents both challenges and opportunities. While establishing a strong foothold in their home country is essential, expanding into international markets can unlock growth and diversify revenue streams. So, how can entrepreneurs build a startup that is rooted in domestic soil but poised for international success?

Understanding Domestic Market Dynamics

Before venturing into international territories, it’s crucial for startups to first solidify their position in the domestic market. Understanding local consumer preferences, market trends, and regulatory environments lays the groundwork for success. Conducting thorough market research and gathering insights into customer needs and behaviors will inform product development and marketing strategies tailored to the domestic audience.

Cultivating a Global Mindset

While focusing on the domestic market, entrepreneurs should cultivate a global mindset from the outset. This means designing products and services with scalability and adaptability in mind. By anticipating future international expansion, startups can build flexible infrastructures and establish partnerships that facilitate cross-border growth. Embracing diversity within the team and seeking input from individuals with international experience can also broaden perspectives and foster innovation.

Leveraging Technology and Digital Platforms

Technology has democratized access to global markets, enabling startups to reach customers worldwide from virtually anywhere. Leveraging digital platforms for marketing, sales, and distribution can extend the reach of a startup beyond national borders. E-commerce platforms, social media channels, and digital advertising offer cost-effective ways to engage with international audiences and test market demand in different regions.

Establishing Strategic Partnerships

Collaborating with local partners in target international markets can accelerate the expansion process and mitigate risks. Strategic partnerships with distributors, resellers, or local businesses provide startups with invaluable market insights, access to networks, and logistical support. Building relationships with industry associations, trade organizations, and government agencies can also facilitate market entry and navigate regulatory complexities abroad.

Embracing Cultural Sensitivity

Cultural nuances play a significant role in business interactions and consumer preferences worldwide. Startups aspiring for international success must demonstrate cultural sensitivity and adaptability in their approach. This involves tailoring marketing messages, product features, and customer support to resonate with diverse cultural backgrounds. Investing in language localization, cultural training for staff, and cross-cultural communication tools can enhance the startup’s ability to connect with international audiences.

Prioritizing Compliance and Legal Considerations

Expanding into international markets requires startups to navigate a myriad of legal, regulatory, and compliance requirements. From intellectual property protection to tax obligations and data privacy regulations, understanding and adhering to local laws is essential for long-term success. Seeking legal counsel and consulting experts familiar with the legal landscape in target markets can help startups navigate these complexities and avoid costly pitfalls.

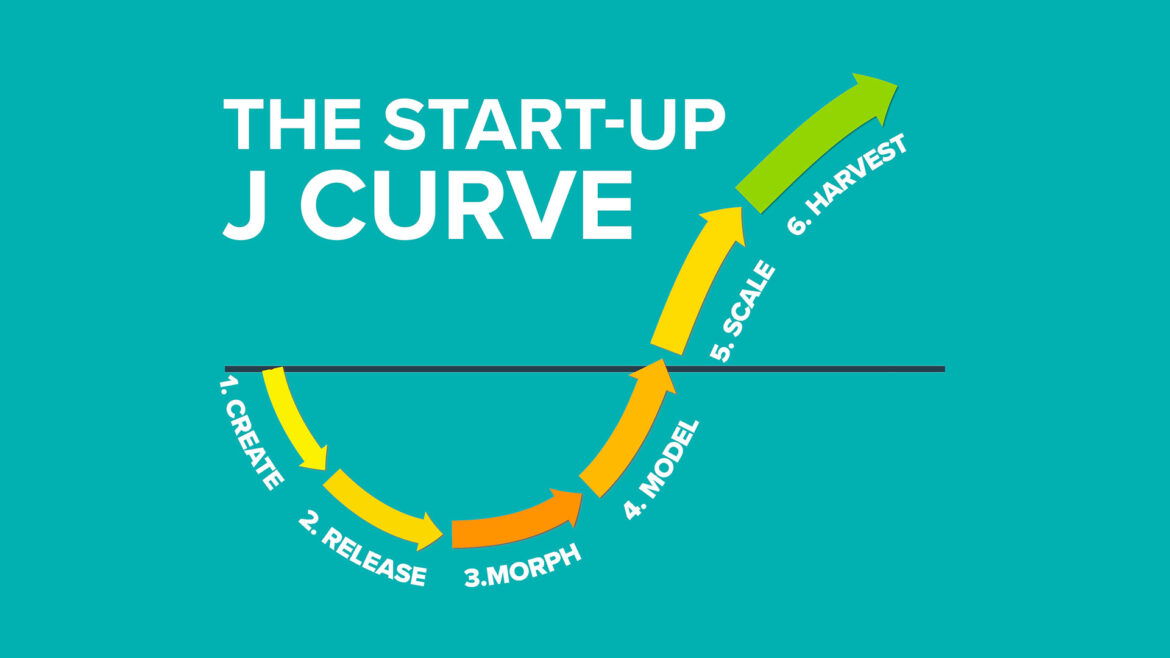

Strategies for Scaling a Domestic Startup Internationally

Building a domestic startup with international ambitions requires a strategic approach that balances local relevance with global scalability. By understanding domestic market dynamics, cultivating a global mindset, leveraging technology, establishing strategic partnerships, embracing cultural sensitivity, and prioritizing compliance, entrepreneurs can position their startups for success on the international stage. While the journey may be challenging, the rewards of tapping into global opportunities are boundless for those willing to venture beyond borders.

Photo via Intradebook