RAISE Final Conference

RAISE Final Conference https://theraise.eu/wp-content/uploads/2024/05/2024-05-15_13h03_28-1024x582.png 1024 582 RAISE fosters startup growth and scale-up within and across Europe https://theraise.eu/wp-content/uploads/2024/05/2024-05-15_13h03_28-1024x582.pngThe EU-Startups Summit 2024 in Malta marked the conclusion of the RAISE project, where over 50 participants gathered to celebrate the culmination of efforts aimed at fostering startup growth through enhanced ecosystem connectivity.

Led by project coordinator Giorgio Alessandro from SERN (Startup Europe Regions Network), the final conference featured a summary of the project’s activities.

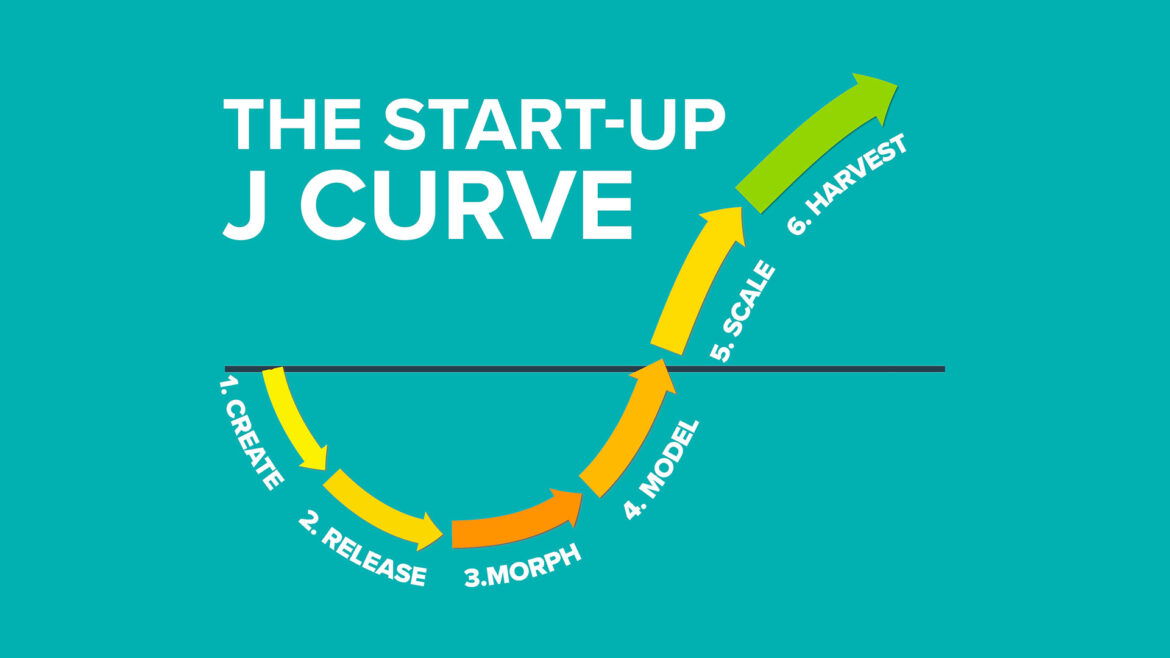

The main goal of RAISE was to develop a new and sustainable integrated support framework to foster start-up growth and scale-up across Europe in all its dimensions, from initial funding and research support to public incentives and internationalisation. This resulted in the promotion of competitive business models, unconventional collaborations, and solutions across Europe, contributing to the establishment of a true EU startup ecosystem that linked multiple cities and regions together. RAISE established a joint agenda to build effective collaboration among key innovation ecosystem players at the regional, national, and EU levels. All these players played a crucial role in the start-ups’ growth lifecycle through upskilling initiatives, research and innovation (R&I) programmes and policies, capacity building, private investment, and access to public funding.

How to turn Europe into an interconnected startup ecosystem?

Professor Rudy Aernoudt’s keynote address, titled “How to turn Europe into a world startup ecosystem?” provided invaluable insights into overcoming obstacles and shaping effective policies. Professor highlighted that 36% of world-wide startups are EU-based. He continue further to list obstacles for EU startups: uncertainty about the future, regulatory setbacks and cost effectiveness, cultural difference and mindset of Europeans, lack of capital and financial risks. Prof Aernoudt concluded that there is a need for broad evidence-based policies to support European startup ecosystem in today’s turbulent environment.

RAISE Pilot Actions

Alessandro Craglia from EBAN (European Business Angel Network) showcased pilot initiatives crafted by the RAISE project, spanning business model refinement, partnership cultivation, access to funding and ventural capital, talent acquisition, and the promotion of women and rural entrepreneurship. Verklaren’s testimonial underscored the tangible benefits experienced by startups engaged in RAISE activities. As a small international consulting company, Verklaren managed through ICoRSA mentorship sessions and RAISE pilot action to set a new value proposition, define a new market target, and set strategic direction towards collaboration with European NGOs and EU-finance projects.

Startup Support Map

Giacomo Frisanco from EURADA (European Association of Development Agencies) introduced the Startup Support Interactive Map, a tool designed to assist startups in navigating European Structural and Investment Funds. The RAISE project team launched an innovative interactive map, now available on the project website, showcasing regional support policies and measures for startups across the European Union. This new resource, developed under the RAISE Project Work Package 3 – Preparation for Future Implementation of Common Action Plans, is designed to assist startups in navigating the diverse landscape of regional support programmes. The map currently includes information on five European regions (Portugal, Spain, Italy, Croatia, and Romania) and 15 initiatives funded by EU Structural Funds. Users can navigate the map, click on pins for detailed information about each initiative, and access programme webpages for more details.

Common Action Plan

Presenting the Common Action Plan by Giorgio Alessandro marked a significant moment, synthesising the needs and expectations of the startup sector based on extensive research and guidance from the RAISE Regional Steering Group. The RAISE Consortium initially defined 80 activities – 10 for each one of

the 8 dimensions of the SNS (Standard Nations Startup). He elaborated about aims of Common Action Plan on five key dimensions: Action, Objective, Stakeholders, Policy milestone and Timeframe.

The summit concluded with a dynamic panel discussion moderated by Cristina Gallardo Rey (Fundecyt), featuring Rudy Aernoudt, Greta Camilleri, and Philippe Séjalon, facilitating lively discourse on the challenges and opportunities within the European startup landscape. With interactive QnA session, participants had opportunity to ask the burning questions and get answers from perspective of government, academia and business. Throughout the day, prominent speakers and case studies provided valuable insights into the outcomes of the RAISE project.

RAISE’s journey dedicated to bridging gaps and uniting regions to shape a true EU startup ecosystem

Reflecting on RAISE’s journey, the project has been dedicated to bridging gaps and uniting regions to shape a true EU startup ecosystem without boundaries. From funding to research support and internationalisation, RAISE has championed collaboration, linking stakeholders from local to international levels.

As RAISE concludes its journey, it leaves behind a legacy of interconnectedness, collaboration, and empowerment. The project’s efforts have nurtured startup growth and scale-up across Europe, marking a significant step towards a vibrant and resilient European startup ecosystem.

In summary, the RAISE project stands as a testament to the power of collaboration and collective action in driving positive change within the European startup landscape.

You can find full presentation from the final conference below: