Unleashing Innovation: Exploring the Dynamic Benefits of Startups

Unleashing Innovation: Exploring the Dynamic Benefits of Startups https://theraise.eu/wp-content/uploads/2023/08/startup-with-Company-Suggestion-1-1.jpg 973 540 RAISE fosters startup growth and scale-up within and across Europe https://theraise.eu/wp-content/uploads/2023/08/startup-with-Company-Suggestion-1-1.jpgIn today’s fast-paced and competitive business landscape, startups have emerged as dynamic engines of innovation and economic growth. These small, agile ventures are driven by bold ideas, entrepreneurial spirit, and a hunger to disrupt established norms. Beyond the allure of potentially striking it big, startups offer a range of benefits that extend far beyond financial gains. This article delves into the manifold advantages that startups bring to economies, industries, and individuals alike.

Driving Innovation

One of the most significant contributions of startups is their role as catalysts of innovation. These ventures thrive on pushing boundaries, seeking novel solutions, and challenging conventional wisdom. With limited resources and a keen focus, startups are more inclined to experiment with cutting-edge technologies, unconventional business models, and inventive products. This not only leads to breakthroughs within the startup itself but often inspires larger corporations to adopt innovative practices, fostering a culture of continuous improvement across industries.

Job Creation and Economic Growth

Startups are vibrant job creators that inject fresh vitality into economies. As these enterprises expand, they create a demand for a diverse range of skills, from technical expertise to marketing and management. By tapping into a younger workforce, startups also bring new perspectives and a willingness to adapt to changing trends. This job creation not only lowers unemployment rates but also contributes to overall economic growth through increased consumer spending and tax revenues.

Agility and Adaptability

In a rapidly evolving business environment, agility is key. Startups are inherently nimble, able to pivot and adapt their strategies quickly in response to market feedback and emerging trends. Unlike larger corporations burdened by layers of bureaucracy, startups can make decisions swiftly, making them more responsive to shifting consumer preferences and technological advancements. This adaptability allows startups to stay ahead of the curve and seize opportunities that larger players might miss.

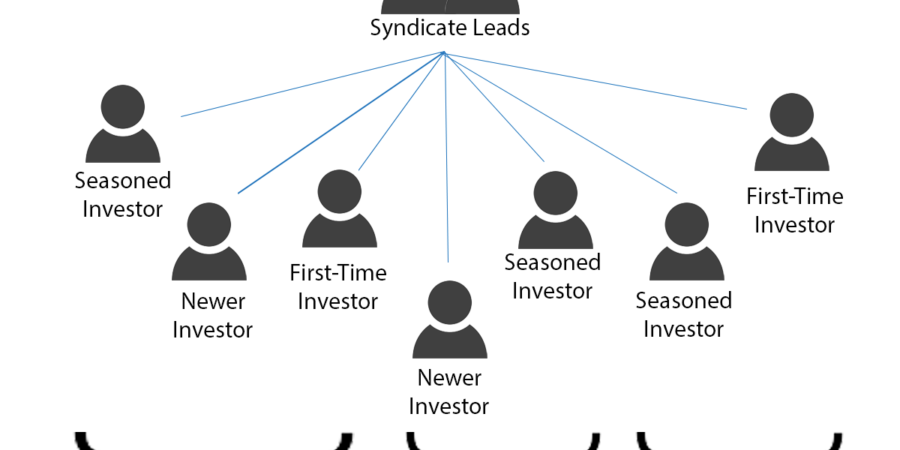

Cultivating Entrepreneurial Ecosystems

Startups don’t operate in isolation; they thrive within interconnected entrepreneurial ecosystems. These ecosystems encompass investors, mentors, accelerators, and other support structures that provide guidance, funding, and resources to budding entrepreneurs. As startups succeed and grow, they contribute to the development of these ecosystems, creating a virtuous cycle that encourages further innovation and collaboration.

Disrupting Traditional Industries

Startups are often synonymous with disruption, as they challenge established industries and models. This disruption can lead to positive changes, such as increased competition, improved consumer choices, and enhanced efficiency. Established players are forced to reevaluate their strategies and offerings, ultimately benefiting consumers and driving overall industry progress.

Fostering Creativity and Ownership

Startups provide a fertile ground for creative thinkers to turn their ideas into reality. The sense of ownership and direct impact on the company’s direction can be incredibly motivating for employees, leading to a vibrant and passionate work environment. This ownership mentality drives employees to go the extra mile, contributing to the company’s success and creating a culture of innovation.

Summarization

Startups are more than just small businesses; they are vehicles of change that fuel innovation, drive economic growth, and disrupt industries. From fostering a culture of innovation to generating jobs and reshaping traditional markets, startups play a vital role in shaping the future. As economies continue to evolve, nurturing and supporting startups will remain crucial for harnessing the power of entrepreneurship and driving progress across the global business landscape.

Photo: iPleaders