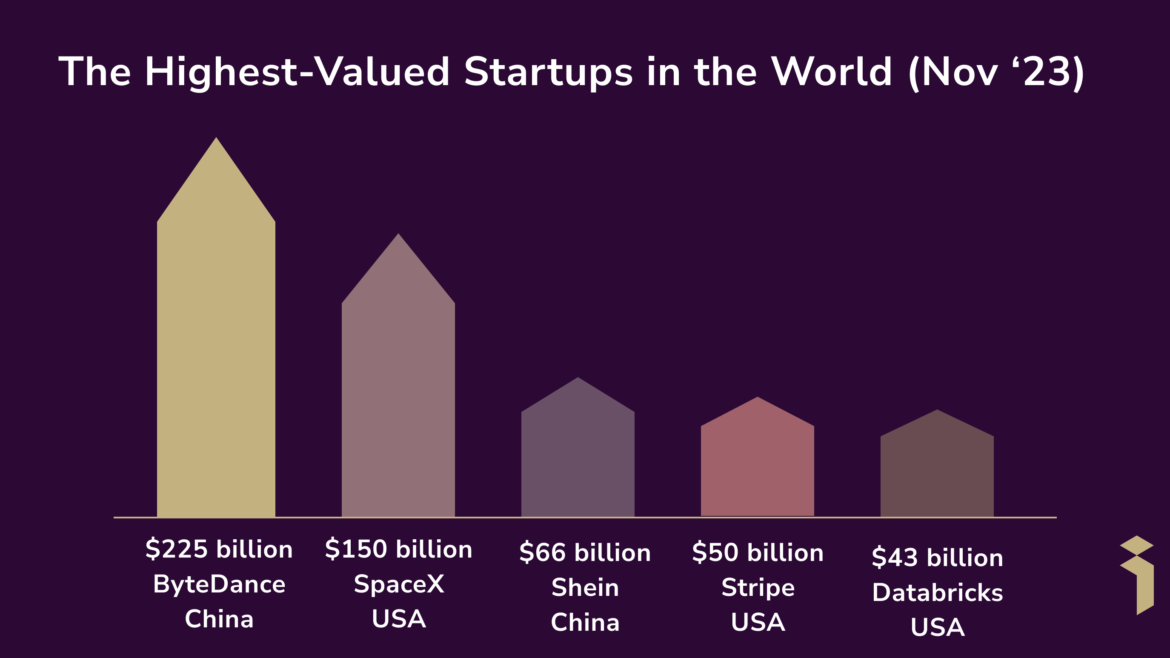

The World’s Highest Valued Startups

The World’s Highest Valued Startups https://theraise.eu/wp-content/uploads/2024/04/IT_Services_Outsourcing_Market_growth_54234373d3-1-1024x550.png 1024 550 RAISE fosters startup growth and scale-up within and across Europe https://theraise.eu/wp-content/uploads/2024/04/IT_Services_Outsourcing_Market_growth_54234373d3-1-1024x550.pngWhen discussing about technology and innovation, startups often emerge as the vanguard, challenging conventions and reshaping industries. Among these rising stars, a select few have soared to stratospheric heights, commanding valuations that rival those of established giants. Let’s delve into the world of high-value startups and unravel the stories behind their meteoric rise.

1. ByteDance: The Trailblazer in Social Media and AI

At the zenith of our list sits ByteDance, the Chinese tech behemoth behind the wildly popular video-sharing platform TikTok. Founded by Zhang Yiming in 2012, ByteDance swiftly ascended to prominence with its innovative use of artificial intelligence to curate personalized content for users. TikTok’s explosive growth, particularly among Gen Z audiences, propelled ByteDance to unprecedented valuation heights, solidifying its status as a global powerhouse in social media and AI-driven technologies.

2. SpaceX: Pioneering the Final Frontier

In the realm of space exploration and aerospace technology, few names evoke as much awe and admiration as SpaceX. Founded by Elon Musk in 2002 with the audacious goal of revolutionizing space travel, SpaceX has achieved remarkable milestones, from launching the first privately funded spacecraft to dock with the International Space Station to pioneering the development of reusable rocket technology. With ambitions ranging from colonizing Mars to deploying a global satellite internet network, SpaceX continues to push the boundaries of human space exploration, earning it a lofty valuation and a place among the elite startups of the world.

3. Shein: Redefining Fast Fashion in the Digital Age

In the world of e-commerce, Shein has emerged as a disruptor, redefining the landscape of fast fashion with its agile, data-driven approach. Founded in 2008 by Chris Xu, Shein leverages its advanced supply chain management and algorithmic-driven marketing to rapidly churn out trendy, affordable apparel that resonates with millennial and Gen Z consumers worldwide. With a relentless focus on user experience and rapid expansion into new markets, Shein has swiftly climbed the ranks to become one of the world’s most valuable startups, disrupting traditional retail models in the process.

4. Stripe: Empowering the Digital Economy

As the backbone of online payments and financial technology, Stripe has positioned itself at the forefront of the digital revolution. Founded by Irish brothers Patrick and John Collison in 2010, Stripe offers a suite of payment processing solutions tailored to the needs of online businesses, from startups to multinational corporations. With its seamless integration, developer-friendly APIs, and commitment to innovation, Stripe has garnered widespread acclaim, attracting a legion of loyal customers and investors alike, propelling its valuation to stratospheric heights.

5. Databricks: Unleashing the Power of Big Data and AI

Rounding out our list is Databricks, a trailblazer in the realm of big data analytics and artificial intelligence. Founded by the creators of Apache Spark in 2013, Databricks provides a unified analytics platform that empowers organizations to harness the full potential of their data through advanced analytics, machine learning, and collaborative data science. With its scalable, cloud-native architecture and cutting-edge technology stack, Databricks has garnered significant traction among enterprises seeking to unlock insights and drive innovation, catapulting its valuation to unprecedented levels.

A Glimpse into the Future

As we peer into the future of technology and innovation, these high-value startups serve as harbingers of change, shaping industries, and rewriting the rules of the game. With their bold vision, disruptive technologies, and unwavering determination, they stand poised to redefine the contours of our digital landscape, inspiring a new generation of entrepreneurs to dream big and reach for the stars.

Photo via Impressit