Market Research and Data-Driven Decisions

Market Research and Data-Driven Decisions https://theraise.eu/wp-content/uploads/2024/01/ALex-1024x576.jpg 1024 576 RAISE fosters startup growth and scale-up within and across Europe RAISE fosters startup growth and scale-up within and across Europe https://theraise.eu/wp-content/uploads/2024/01/ALex-1024x576.jpgIn a series of sessions, “Leveraging Research(ers) for Startup Success” event, organized by the RAISE team and led by the International Consortium of Research Staff Associations (ICoRSA), highlighted the significant role that researchers play in driving innovation, fostering real-world impact, and nurturing talent within the dynamic startup ecosystem. At the forefront of this series was Session 3, titled “Market Research and Data-Driven Decisions,” held on November 15, 2023, and featuring Alexandra Potter-Hnativ from Silent Accelerator, Belgium.

The session delved into critical aspects that form the bedrock of successful market research and data-driven decision-making for startups. Among the key discussions were:

1. How to Conduct Market Research and Develop an Innovation Funnel?

Market research is not just about gathering data but understanding how to leverage it strategically. The innovation funnel is a systematic approach to idea generation, validation, and implementation, ensuring a streamlined process for startups to bring their ideas to market.

2. Validating Ideas with the Market and Accelerating Product/Market Fit for Tech-Driven Startups

The session emphasized the importance of validating ideas with the market as a crucial step in the journey of technology-driven startups. Potter-Hnativ highlighted methods to accelerate the process of finding product/market fit, an essential element for startup success. By aligning ideas with market needs, startups can refine their offerings and enhance their chances of success in a competitive landscape.

3. Data-Driven Insights: Unlocking the Power of Consumer Behavior Analysis

A central theme of the session revolved around data-driven insights and their role in providing startups with a competitive edge. Potter-Hnativ unraveled the methodologies researchers employ to conduct market research and analyze consumer behavior. By harnessing data, startups can make informed decisions, understand market trends, and tailor their strategies to meet consumer demands effectively.

4. Shaping Startup Strategies: Impactful Instances of Research-Driven Market Insights

The session concluded with compelling instances showcasing how research-driven market insights have significantly influenced startup strategies. Whether adapting to changing consumer preferences or pivoting in response to market dynamics, startups armed with research-backed insights are better equipped to navigate challenges and chart a course toward sustainable growth.

The “Leveraging Research(ers) for Startup Success” event underscored the transformative impact that market research and data-driven decision-making can have on the trajectory of startups. As the entrepreneurial landscape continues to evolve, the integration of research-driven insights remains a cornerstone for success, guiding startups towards innovation, market relevance, and enduring impact.

Principles for Successful Market Research in Startups

In this insightful presentation, we’ve delved into ten essential principles that form a strategic framework for conducting effective market research in the startup ecosystem. These principles encompass crucial aspects such as customer insights, data collection, product-market fit, metric tracking, organizational teamwork, and the nuanced interpretation of quantitative and qualitative data. By understanding and applying these principles, startups can enhance their ability to navigate market dynamics, meet customer needs, and make informed strategic decisions, ultimately increasing their chances of success in the competitive business landscape.

The First Principle: the Essence of Market Research: Decoding its Scope and Significance

In the intricate landscape of product development, market research emerges as a beacon guiding businesses through the tumultuous journey of ideation to fruition. Let’s embark on a journey to demystify market research, understanding its depth, scope, and the significant role it plays in the symbiotic relationship between marketing and product development.

Going Beyond the Surface: Market Research Demystified

Market research, often considered the compass for entrepreneurial ventures, transcends mere data collection. It embodies a comprehensive exploration, aiming to uncover nuanced consumer behaviors, market trends, and potential pitfalls. Going beyond the surface, market research is the bridge that connects innovative ideas with real-world demands.

Exploring the Natural Connection between Marketing and Product Development

In the natural progression of product development, marketing and market research intertwine seamlessly. Marketing relies on the insights gleaned from market research to craft compelling strategies, while product development aligns itself with these strategies to meet market needs effectively. This symbiotic relationship underscores the innate connection between marketing, product, and the invaluable insights derived from meticulous market research.

The Essence of Market Research: Acquiring Data and Understanding the Market Dynamics

Central to market research is the acquisition of data, but it transcends the mere collection of statistics. It entails understanding the intricate dynamics of the market, decoding consumer preferences, and forecasting trends. What data is essential in this pursuit, and how can it be harnessed to not only meet the demands of the present but also anticipate the needs of the future? These are the questions that market research seeks to answer, making it an indispensable compass for product developers navigating the ever-evolving business landscape.

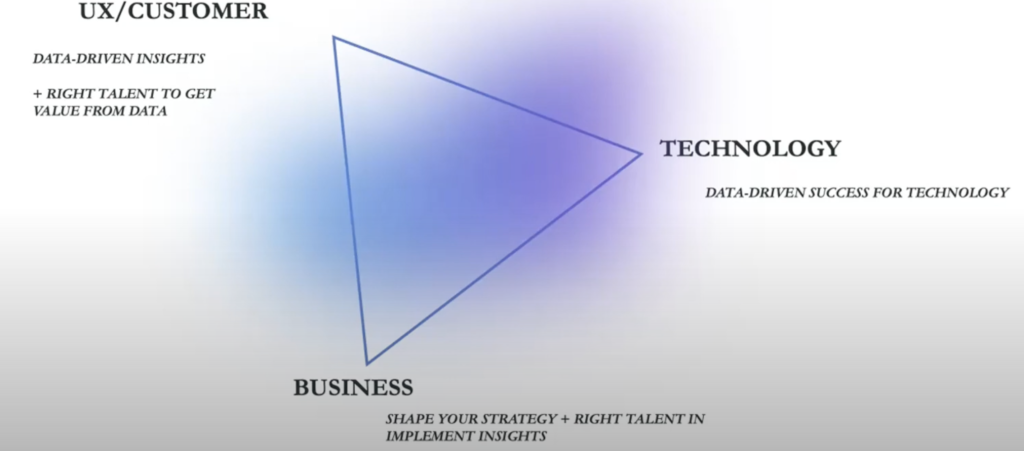

As we delve deeper into the product development journey, we unravel the layers of the first principle – the Product Success Triangle, which revolves around understanding the customer, leveraging data talent, and crafting business strategies that propel product development into realms of success.

Navigating the Product Success Triangle: A Holistic Approach

In the realm of product development, the journey to success is charted through a multifaceted approach encapsulated by the Product Success Triangle. This framework, an amalgamation of customer-centricity, data prowess, and strategic business acumen, propels startups and businesses towards achieving sustainable growth. Let’s delve into the intricacies of each dimension and understand how they harmonize to steer the product development voyage.

The Customer-Centric Core: The Path to Insightful Development

At the heart of the Product Success Triangle lies the customer – the North Star guiding every decision and innovation. It entails understanding the intricacies of the market, deciphering consumer behaviors, and distilling these insights into actionable strategies. By peeling back the layers of customer preferences, pain points, and aspirations, businesses gain a profound understanding that forms the bedrock of successful product development.

Data Prowess: Translating Numbers into Strategic Advantages

Data, often hailed as the new currency, assumes a significant role in the Product Success Triangle. However, it’s not merely about amassing data but transforming it into strategic advantages. For startups, the advantage lies in agility – the ability to swiftly collect, interpret, and act upon data. Unlike large corporations, startups have the flexibility to adapt swiftly, turning data-driven insights into tangible product enhancements. It’s not about the quantity of data but the acumen to extract meaningful patterns that fuel innovation.

Strategic Business Acumen: Bridging Data and Development with Informed Strategies

While data highlights the path, strategic business acumen serves as the guide, directing product development towards market success. The insights gleaned from market research and data analytics are channeled into formulating business strategies that align with market demands. This strategic layer ensures that every product iteration, enhancement, or launch is a calculated move, minimizing risks and maximizing market penetration.

As we traverse the landscape of the Product Success Triangle, it becomes apparent that success is not an isolated achievement but an orchestrated symphony of customer understanding, data utilization, and strategic finesse.

Embracing Data-Driven Success: The Crucial Role of Market Research

Embarking on the trajectory of market research, startups unravel the bedrock of insights that can propel their journey toward success. In the evolving landscape of innovation and technology-driven startups, leveraging market research is not just a prerogative but a strategic imperative. Let’s dissect the key components of this essential process and show how it contributes to the dynamic interplay within the Product Success Triangle.

Market Research: Decoding the Layers of Consumer Behavior

Market research serves as the compass that guides startups through the intricate labyrinth of consumer behavior. Understanding the needs, desires, and pain points of the target audience is not a luxury but a necessity. This phase involves meticulous data collection, surveys, and analysis to unravel the layers of consumer behavior, providing a foundation for informed decision-making.

Validation Through Market Interaction: From Ideas to Viable Products

An important aspect of market research is the validation of ideas through direct interaction with the target market. Startups need to gauge the resonance of their concepts, ensuring alignment with market needs. This iterative process involves constant refinement based on real-time feedback, fostering the evolution of ideas into viable products that seamlessly integrate with consumer expectations.

Accelerating Product-Market Fit: The Nexus of Innovation and Demand

Market research acts as the accelerator, propelling startups towards achieving the coveted product-market fit. By aligning product development with validated market needs, startups can bridge the gap between innovation and demand. This alignment ensures that every feature, enhancement, or innovation resonates with the pulse of the market, fostering a symbiotic relationship between product evolution and consumer requirements.

Data-Powered Guidance: Navigating the Complexities with Precision

In the data-driven era, startups are bestowed with a trove of information. Market research, when coupled with robust data analytics, provides startups with data-powered guidance. It’s not just about knowing the market; it’s about deciphering the nuances within the data to glean actionable insights. This guidance becomes the north star, steering startups away from potential pitfalls and towards strategic decisions rooted in market realities.

Shaping Strategies: A Market-Infused Approach to Startup Growth

Armed with insights from market research, startups can craft strategies that resonate with their audience. From product positioning to marketing campaigns, every facet of a startup’s strategy can be infused with market intelligence. This ensures that resources are channeled efficiently, maximizing impact and fostering growth in alignment with market dynamics.

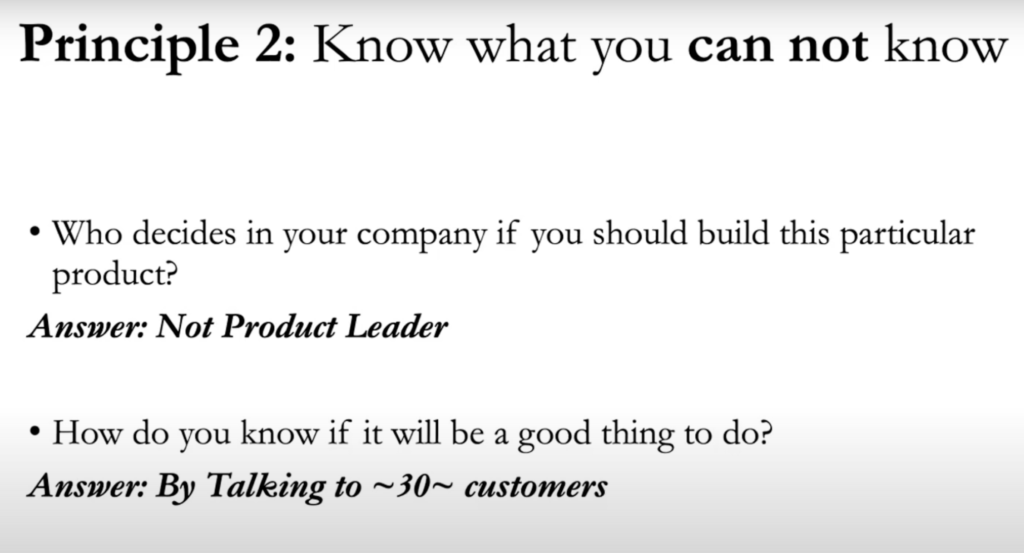

Principle Two: Embracing the Unknown in Market Exploration

The second principle ushers us into the realm of embracing the unknown—a significant facet in the journey of market exploration. As founders embark on the quest to shape their companies, understanding what they don’t know becomes a compass guiding them through uncharted territories. Let’s unravel the layers of this principle, which serves as a beacon for those navigating the intricate landscape of entrepreneurship.

The Quest for Knowledge: A Founder’s Role in Market Discovery

In the entrepreneurial landscape, being a founder involves more than possessing all the answers—it’s about knowing what questions to ask. The principle emphasizes the importance of founders, or those in the early stages of envisioning their companies, recognizing the value of exploring the unknown. This is particularly vital when it comes to decisions about product development, market positioning, and overall company strategy.

Dispelling the Myth of Solitary Decision-Making

One question surfaces prominently in the entrepreneurial journey: “How do you decide what to build?” The fallacy lies in assuming that a founder, often the author of the technology, should single-handedly bear the responsibility for all decisions within the company. The second principle challenges this notion, asserting that decisions are not unilateral but should involve a dynamic interplay between the product leader, the market, and consumers.

The Market as a Collaborative Decision-Maker

Contrary to a centralized decision-making approach, the principle underscores that the market and consumers play an instrumental role in shaping decisions. While a founder may have a strong vision, true success is found in aligning that vision with the needs and expectations of the market. The guiding principle encourages a collaborative approach, where decisions are influenced by the dynamic dialogue between a company and its audience.

Empowering Validation: Engaging with Potential Customers

For founders seeking validation and insights, a practical approach involves engaging with potential customers. This market research, devoid of substantial budgets, hinges on direct conversations. A key recommendation is to reach out to a diverse group of individuals, avoiding the echo chamber of friends and family. The principle suggests interacting with 30 to 50 independent individuals to glean authentic perspectives untainted by internal biases.

Market Research on a Shoestring: A Call to Action

As a guiding principle, embracing the unknown encourages founders to embark on cost-effective market research journeys. Dispelling the myth that decisions rest solely on the shoulders of a founder, the principle champions collaboration with the market and consumers. It underscores that, even in the absence of exhaustive budgets, meaningful insights can be derived through genuine conversations, ultimately steering the company toward informed and collective decision-making.

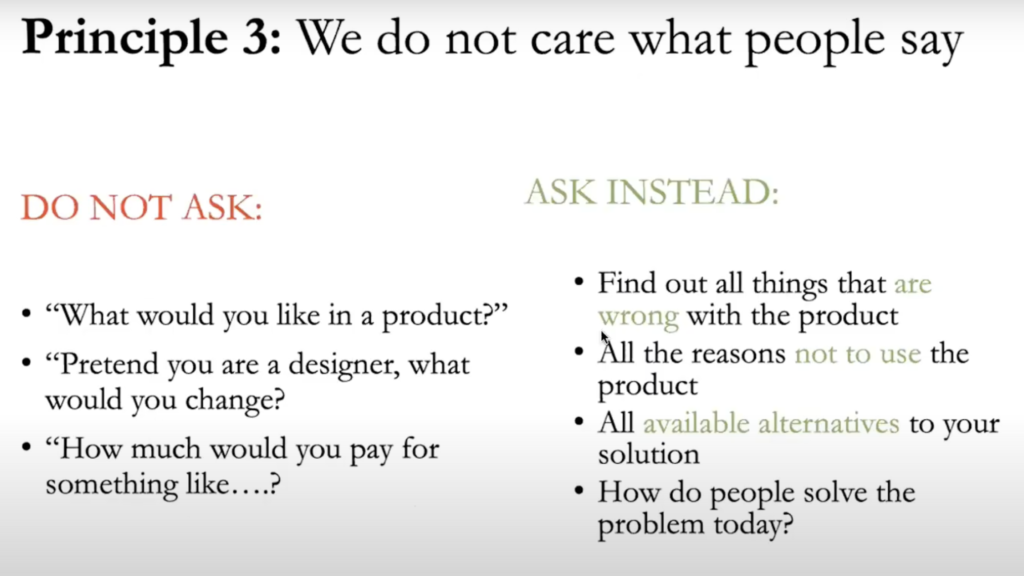

Principle Three: Unmasking Truths in Customer Interactions

As the journey unfolds and founders engage with potential customers, Principle Three shows a critical reality—customer statements aren’t always an unfiltered representation of truth. The principle crystallizes around a fundamental ethos: “We don’t care what people say.” In the intricate realm of market research, the principle emphasizes the need to discern beyond verbal affirmations and delve into genuine customer behavior. Let’s explore the essence of this principle and the strategic approach it advocates.

The Deceptive Nature of Verbal Affirmations

Market research often encounters a common pitfall: the disjunction between what customers articulate and their subsequent actions. Traditional questions like, “Do you like my product?” or “How much would you pay for it?” often yield responses that diverge from actual behaviors when faced with the product in real scenarios. Acknowledging this dissonance becomes important in navigating the complex landscape of customer interactions.

Trusting Actions Over Words: A Foundational Shift

The guiding principle asserts that while customers may accurately articulate their problems and pain points, their understanding of how these problems should be solved can be inherently flawed. Here lies the crux—founders, particularly those with an engineering or inventive background, must recognize the limitations of explicit questioning. Rather than relying solely on what customers say, the principle advocates a profound shift toward observing customer reactions in natural settings.

Understanding the Truth in Problems

Customers, undeniably, are accurate in expressing their problems and needs. The principle underscores the reliability of customer insights when it comes to identifying pain points, unmet needs, or gaps in the market. This becomes a cornerstone for founders aiming to tailor their solutions to genuine customer demands.

Observational Wisdom: A Subtle Approach to Uncover Truth

The principle offers practical guidance for founders—observe, don’t interrogate. Rather than posing leading questions that elicit socially acceptable responses, opt for a more subtle approach. Understanding how customers naturally interact with a product or service provides nuanced insights that explicit queries may fail to capture.

Propelling Realism through Commitment

Moving forward in the market research journey, the principle advocates propelling realism by moving beyond superficial discussions. Founders are encouraged to prompt customers to subscribe, commit to payments, or express a symbolic intent to engage with the product. This swift progression toward tangible commitments aids founders in gauging the actual market readiness of their product or solution.

Accelerating Insights: A Practical Imperative

In essence, Principle Three functions as a practical imperative, urging founders to expedite their understanding of market viability. By navigating past surface-level affirmations, embracing observational wisdom, and fostering customer commitments, founders can unravel the truths concealed within customer interactions, enabling a more realistic assessment of their product’s readiness for the market.

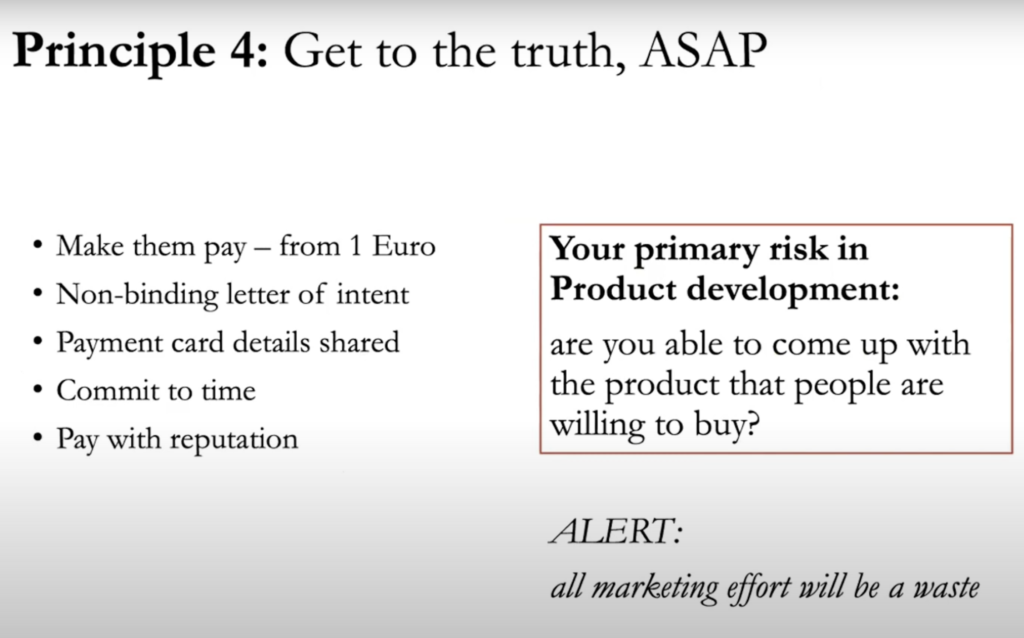

Principle Four: Accelerating Market Understanding: Action-Oriented Approach for Genuine Insights

In Principle 4, the emphasis shifts towards an action-oriented approach, urging founders to seek the truth by prompting real commitments from potential customers. The crux of this principle lies in proposing concrete actions, such as subscription, payments, or symbolic gestures like letters of intent. This approach aims to swiftly gauge the market’s response and determine the actual viability and acceptance of the product or solution. Let’s explore the key components of Principle 4 and how it translates into actionable insights.

Provoking Real Intent: A Direct Path to Market Validation

The essence of this principle lies in the direct engagement of potential customers. Instead of relying solely on verbal feedback, founders are encouraged to propose tangible commitments. This could involve inviting users to subscribe to a service, commit to a payment, or even request symbolic gestures like letters of intent. The immediacy of these actions serves as a litmus test for the true interest and acceptance of the product in the market.

Swift Understanding of Market Readiness

The faster founders can prompt these commitments, the more realistic insights they gain about the product’s readiness for the market. By seeking real financial or symbolic investments from potential customers, founders can bypass hypothetical discussions and gauge actual market demand. This accelerates the understanding of whether the product resonates with the audience and has the potential for success.

Translating Commitments into Actionable Data

Principle 4 advocates for a qualitative approach to data collection. The more interviews conducted and variables introduced—such as different pricing models, feedback mechanisms, or performance metrics—the richer the dataset becomes. This self-collected data serves as a valuable resource for founders, providing nuanced insights into customer behavior, preferences, and the overall market landscape.

Empowering Founders: From Buying Data to DIY Research

The core message underlying Principle 4 is a paradigm shift from buying external data to empowering founders to conduct their own research. Rather than relying solely on pre-existing market reports, founders are encouraged to actively engage with their audience, elicit commitments, and gather firsthand data. This DIY approach not only fosters a deeper understanding of the market but also positions founders as active participants in shaping their product’s trajectory.

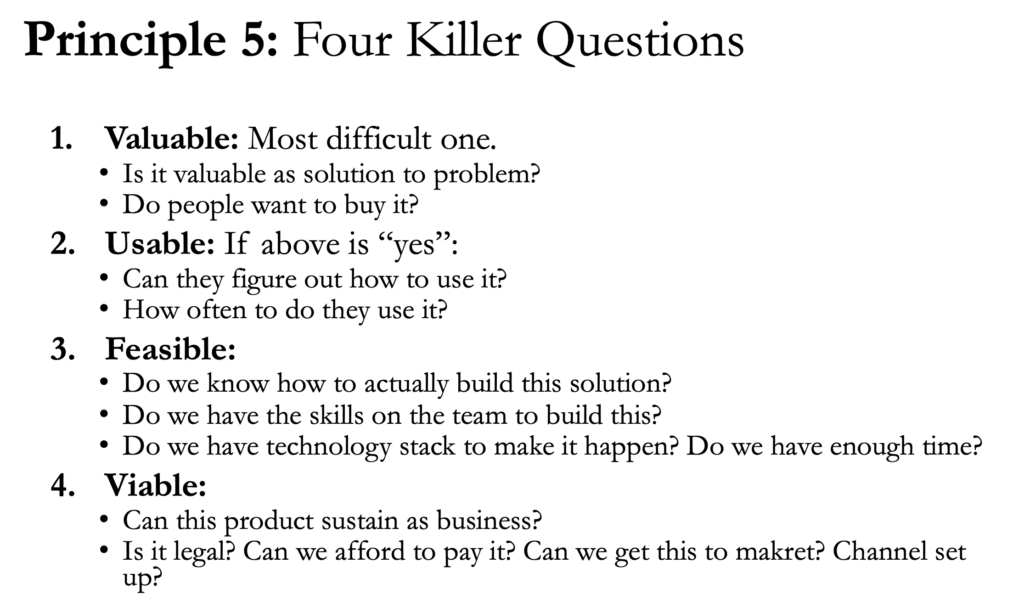

Principle Five: Implementing Four Killer Questions

Principle 5 delves into the practical implementation of data, focusing on four crucial questions that fine-tune the understanding of a product’s impact, usability, feasibility, and overall viability as a business. As founders navigate their data trove, these questions serve as guiding beacons for informed decision-making. Let’s dissect the four killer questions and how they contribute to shaping a successful venture.

1. Value? Elevating Life and Work

The first killer question revolves around the value proposition. Do users feel an enhancement in their lives or a boost in productivity? This centers on gauging the tangible impact of the solution and ensuring that it genuinely elevates the user experience, making their lives or work noticeably better.

2. Usability? The Litmus Test for Sustainable Engagement

Usability becomes an important metric in the second question. It’s not just about having a groundbreaking solution; it’s about making it user-friendly. If a product, despite its brilliance, poses challenges in terms of design or ease of use, user engagement falters. Sustainable engagement depends on how seamlessly users can integrate the solution into their routines.

3. Feasibility? Balancing Ambition with Practicality

Feasibility, the third question, ventures into the realm of technology and engineering. Even if users desire to revisit the product, the feasibility question interrogates the practicality of building and sustaining it. This involves striking a delicate balance between the solution’s cost, production sustainability, and the technical complexities involved.

4. Viability? The Ultimate Business Litmus Test

The fourth and final question crystallises the vision into a business perspective. While a solution may be valuable, usable, and feasible, its viability as a business hinges on economic considerations. If the cost of development and deployment surpasses a threshold, the once-promising venture might falter. This question compels founders to critically evaluate whether the brilliance of the solution aligns with sustainable and profitable business practices.

A Holistic Approach to Decision-Making

Principle 5 advocates for a holistic approach to decision-making, drawing on data from user interviews, social media traction, sales figures, and product usage analytics. By systematically applying the four killer questions to these data sets, founders can distill valuable insights that guide their next steps. This approach ensures that the venture not only addresses user needs but also aligns with practical and economic considerations, fostering a well-rounded path to success.

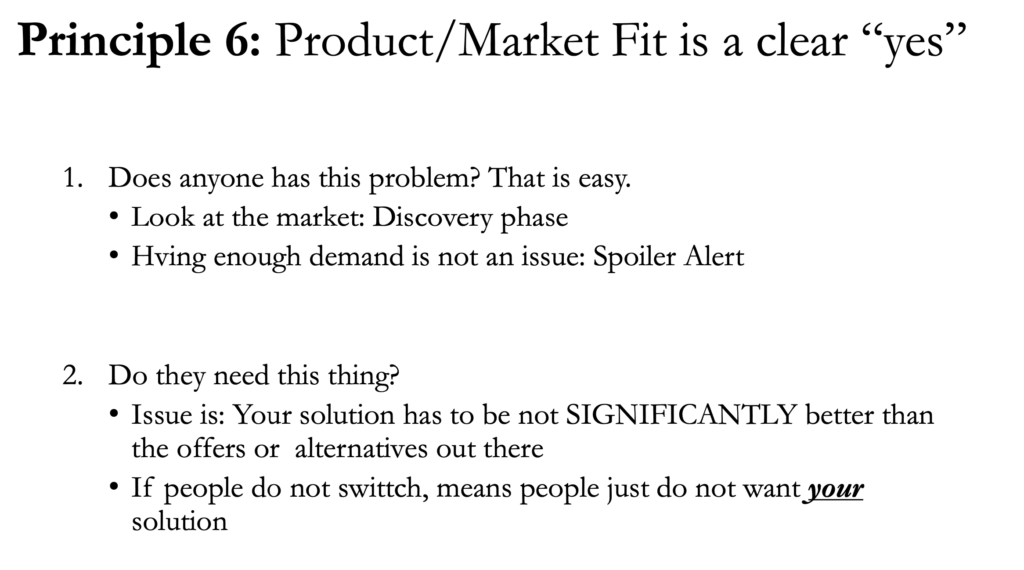

Principle Six: The Culmination: Achieving Product-Market Fit

Principle 6 marks the pinnacle on the business site—a crucial juncture where your product seamlessly aligns with the market. Achieving Product-Market Fit is the culmination of extensive research, data-driven decisions, and a relentless pursuit of meeting customer needs. Let’s unravel the essence of this principle and understand why it’s the sought-after “yes” moment for startups.

The Quest for Alignment

Product-Market Fit is the harmonious alignment of your product with the demands of the market. It’s not just about having a great idea; it’s about that magical point where your solution resonates with your target audience. This alignment signifies that your product isn’t merely a creation but a solution eagerly sought by customers.

The Litmus Test: Overwhelmed by Demand

The litmus test for Product-Market Fit is the surge in demand. When you find the right fit, your customer base extends beyond early adopters, and there’s a palpable enthusiasm to purchase your product. This surge can be overwhelming, indicating that you’ve struck the right chord with your audience.

Knowing You’re on the Right Track

As a founder, this moment serves as validation—a resounding affirmation that your business is on the right track. The resonance between your product and the market signifies that you’ve decoded the intricate puzzle of customer preferences and delivered a solution that addresses their pain points effectively.

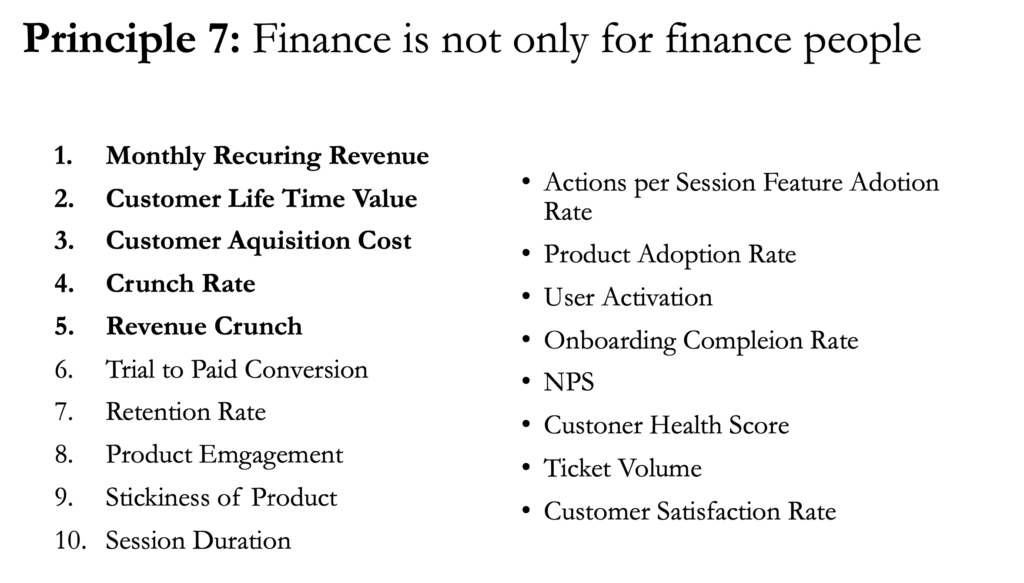

Principle Seven: Navigating Post Product-Market Fit: Metrics that Matter

Principle 7 delves into the crucial realm of metrics, steering you through the post-Product-Market Fit landscape. As you bask in the success of aligning your product with market demands, understanding and measuring key metrics become paramount. Here’s your guide to the metrics that matter and how they pave the way for informed decisions:

A Wealth of Measurable Insights

After achieving Product-Market Fit, the journey continues with metrics that unravel the intricacies of your business. These metrics offer a wealth of measurable insights, empowering you to make data-driven decisions that resonate with the specifics of your product and market.

Financial Metrics: Business Health

Among the array of metrics, financial indicators take center stage. Whether you’re in the software domain or navigating the marketing landscape, financial metrics provide a window into your business health. Monthly Recurring Revenue (MRR), Lifetime Value (LTV), Acquisition Cost, and Churn Rate become guiding lights in assessing the fiscal pulse of your enterprise.

Tailoring Metrics to Your Technology

The beauty lies in tailoring these metrics to your technology and business model. If you’re dealing with software, understanding MRR might be important, while marketers may find LTV and acquisition costs more pertinent. The key is picking metrics that align with your product’s unique journey and the demands of your market.

Beyond the Numbers: Looking at the Right Metric

The essence lies not just in the numbers but in whether you’re looking at the right metrics for your startup. Principle 7 emphasizes that your judgment will be scrutinized based on your choice of metrics—those that align with your product, market, and business objectives.

Navigating the Post-Fit Terrain with Confidence

As you embark on the post-Product-Market Fit journey armed with insightful metrics, you navigate the entrepreneurial terrain with confidence. The metrics become your allies, offering a compass to steer through the challenges and capitalise on the opportunities that emerge after achieving that coveted alignment with the market.

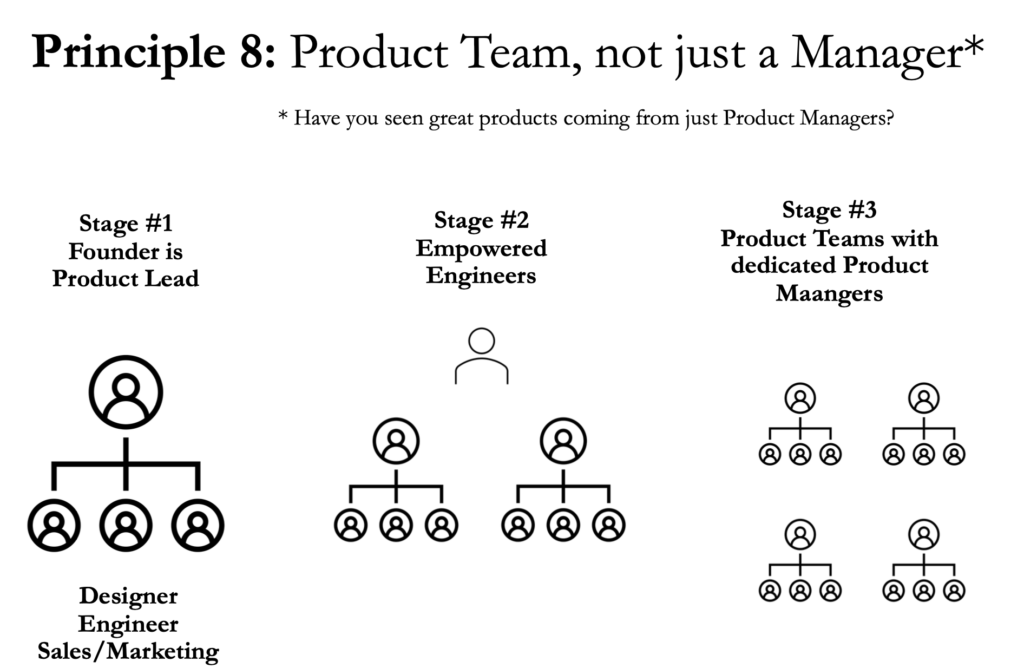

Principle Eight: Team Empowerment and Data-Driven Culture

The journey to data-driven decisions is a collaborative one, emphasizing the need for a cohesive team effort. Organizing your team effectively is crucial to harnessing the power of data. Here’s a guide on how to structure your team at various stages, fostering a culture where data is a shared responsibility:

Stage One: Founder as the Driving Force

In the initial stage, the founder assumes a dual role as both the product lead and marketer. With the responsibility of wearing multiple hats, the founder becomes the central hub where all data converges. This setup emphasizes the founder’s significant role in shaping the data-driven direction of the startup.

Stage Two: Empowered Engineers Taking the Lead

As the startup evolves, a key shift occurs with the emergence of empowered engineers. In technology and innovation-driven companies, engineers with marketing and finance acumen become integral. The message is clear – engineers should not shy away from delving into metrics. Training engineers to understand marketing nuances and financial metrics equips them to contribute meaningfully to data-driven decisions.

Advantages of Engineer Involvement in Metrics

Empowering engineers with marketing skills is an investment that pays off. If a dedicated marketing team is not yet feasible, engineers with basic marketing knowledge can fill the gap. They seamlessly integrate marketing insights into their workflow, ensuring a holistic understanding of metrics, from engineering numbers to marketing dynamics.

Beyond Engineering Numbers: Holistic Market Understanding

Engineers are encouraged to go beyond their traditional scope and grasp marketing intricacies. Understanding how much it costs to sell a product, tracking customer acquisition, and connecting these metrics with their workflow enriches their contribution. This approach proves cost-effective and strategically smart in the long run.

Stage Three: Scaling Up with Dedicated Product Teams

In the advanced stage of scaling up, the team structure replicates the foundational principles established in stage two. Dedicated product teams now inherit the culture of understanding and leveraging metrics. The structure ensures a seamless transition and continuity of the data-driven ethos as the startup grows.

Training and Growth: A Strategic Investment

The emphasis is on training and growing the engineering team with diverse skills. This strategic investment ensures that the team, regardless of its size, possesses a holistic understanding of data, marketing, and finance. It’s not about engineers becoming marketing experts but about integrating fundamental marketing skills into their toolkit.

The Smart Approach: Data-Driven Engineers as Assets

The overarching message is clear – don’t wait until financial capabilities allow hiring a dedicated marketing team. Instead, foster a culture where engineers become assets in the realm of data-driven decisions. This approach is not only cost-effective but also aligns the team with a mindset that values understanding the right metrics for the startup’s journey.

Principle Nine: Crafting Value – Moving Beyond Features

In the ninth principle, the focus shifts towards perceiving your product not merely as a collection of features but as a comprehensive solution that delivers genuine value. This principle underscores the importance of considering your idea holistically, ensuring it transcends individual features to create a compelling and differentiated product.

Avoid Feature-Centric Research

When conducting research, especially interviews or questionnaires, the trap of being overly feature-centric must be avoided. Teams, particularly those with a strong engineering focus, tend to emphasize specific features and their likability. However, the true measure of success lies in evaluating whether the product, as a whole, effectively accomplishes its intended purpose.

Thinking Holistically: The Product as a Whole

Rather than fixating on individual features, envision your idea as an integrated product. A successful product is not defined by a single fancy feature but by its ability to holistically address user needs. Users seldom switch to a product solely for one standout feature; the product must provide a comprehensive solution that outshines competitors.

Differentiation and Worthiness of Switching

Consider the overall user experience and the value proposition your product offers. To entice users to switch or adopt your product, it must go beyond a single feature. Successful products provide a unique combination of features, making the switch not only beneficial but also compelling for users.

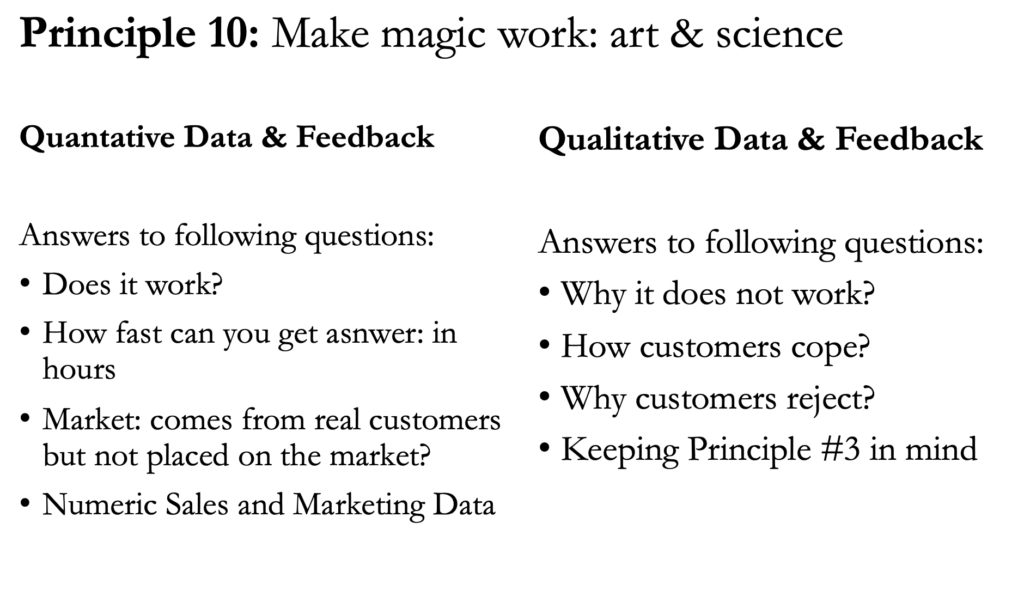

Principle Ten: Growth – The Magic of Interpretation

The tenth and final principle delves into the art of making market research truly impactful. It emphasizes the vital role of interpreting data across two key dimensions: quantitative and qualitative. Understanding the unique insights offered by each dimension is crucial for extracting meaningful conclusions and steering your product in the right direction.

Quantitative Data: Performance Metrics

Quantitative data, often synonymous with performance metrics, swiftly answers fundamental questions about your product. Is it functional? Is it user-friendly? For instance, if your app crashes during an event, quantitative data shows this issue, offering concrete evidence of technical hitches.

Qualitative Data: The Depth of Understanding

On the other hand, qualitative data goes beyond the surface, exploring the ‘why’ behind user actions. It involves deep interviews, focus groups, and keen observations to unearth the intricate motivations and sentiments driving user decisions. This aligns with the wisdom shared in Principle 3, acknowledging that people might not always articulate their true feelings.

Balancing Act: Leveraging Both Data Dimensions

The true magic lies in finding a harmonious balance between quantitative and qualitative insights. While quantitative data paints a quick overview of performance, qualitative data demonstrates the nuanced reasons and emotions influencing user decisions. By skillfully integrating both dimensions, you gain a comprehensive understanding of your product’s strengths and areas for improvement.

Principle 10 Summarized: Growth through Research Implementation

In essence, Principle 10 encapsulates the entire journey of market research, emphasizing that both quantitative and qualitative data must be harnessed to answer critical questions about your product. As a founder, understanding the ‘how’ and ‘why’ behind user interactions can empower you to make informed decisions, thereby unlocking the growth potential of your product.

Q&A Session

1. Understanding the Basics:

Q1: What is the foundational principle of market research mentioned in the presentation? A: The foundational principle is to understand the problem you’re solving and for whom. Instead of asking users what they want, observe their behaviors and understand their pain points.

Q2: How does the presenter emphasize the importance of collecting data? A: Alexandra emphasised that collecting one’s own data through interviews and diverse variables is crucial. This approach enables startups to gather personalised insights and make informed decisions.

2. Key Principles for Effective Market Research:

Q3: What is the significance of the fourth principle? A: This principle urges startups to encourage user commitment, whether through subscriptions, payments, or symbolic actions. The faster a startup can obtain this commitment, the better it can gauge product readiness and user satisfaction.

Q4: Why does the presenter stress the need for varied metrics in the fifth principle? A: Implementing diverse metrics, such as value, usability, feasibility, and viability, helps in thoroughly assessing the product’s potential success and the overall fit in the market.

3. Finding Product-Market Fit:

Q5: What does the presenter suggest indicates achieving product-market fit? A: Product-market fit is indicated when there’s a significant demand for the product, with a line of customers ready to make purchases, leading to a sense of overwhelming demand.

4. Metrics and Financial Considerations:

Q6: Why does the presenter highlight the importance of financial metrics? A: Financial metrics are crucial indicators for business viability. Monthly recurring revenue, lifetime value, acquisition cost, and churn rate help startups understand the financial health and sustainability of their venture.

5. Organizing Teams for Data-Driven Decisions:

Q7: How does the presenter recommend organizing a team for effective market research? A: The presenter suggests a phased approach, starting with founders handling both product and marketing roles, followed by empowered engineers who understand marketing, and eventually, dedicated product teams replicating the established structure.

6. The Value of a Holistic Product:

Q8: What does the seventh principle emphasize regarding the product? A: The principle stresses the importance of viewing the idea not just as a set of features but as a holistic product. Startups should focus on overall product usability and value rather than individual features.

7. Post Product-Market Fit Metrics:

Q9: What are the key metrics recommended after achieving product-market fit? A: Post product-market fit, startups should focus on financial metrics such as monthly recurring revenue, lifetime value, and acquisition cost to make data-driven decisions and guide further growth.

8. Team Organisation for Data Empowerment:

Q10: How does Alexandra suggest organising teams to empower data-driven decisions? A: The presenter recommends building teams that understand both technology and marketing, starting with founders wearing multiple hats, followed by engineers incorporating marketing knowledge, and eventually scaling up with dedicated product teams.

Q11: Why does Alexandra caution against focusing too much on individual features in market research? A: The presenter warns against overemphasising specific features and encourages startups to view their ideas as complete products. Users seldom switch to a new product for a single feature; it must offer a comprehensive and differentiated value.

9. The Magic of Market Research:

Q12: How does the presenter highlight the dual dimensions of market research data? A: The presenter distinguishes between quantitative and qualitative data, with quantitative data answering yes/no questions about product performance, while qualitative data, obtained through interviews, reveals the reasons behind user preferences and behaviours.

About the Speaker

Alexandra Potter-Hnativ, MBA is a talented Venture Builder & Go-To-Market Advisory.

Alexandra’s professional journey began in a marketing communication agency, where she developed her skills and discovered a passion for understanding market dynamics and consumer behaviour. This early experience set the stage for her subsequent career at the intersection of marketing and technology.

A significant chapter in Alexandra’s career unfolded during her time at Solvay, a Belgian Chemical Company. Assigned to explore the role of specialty polymers in the fast-moving consumer goods (FMCG) industry, she delved into market research, sparking her interest in leveraging data for informed decision-making.

The journey continued as Alexandra moved to AB InBev, a major player in the global beer industry. Managing a substantial budget for market research, she gained a unique perspective on the challenges and opportunities of procuring and utilising market data in a large consumer-centric company. Her career trajectory showcases a practical and results-driven approach to navigating the complexities of marketing and technology.

- Posted In:

- RAISE News