Startup Financing Cycle

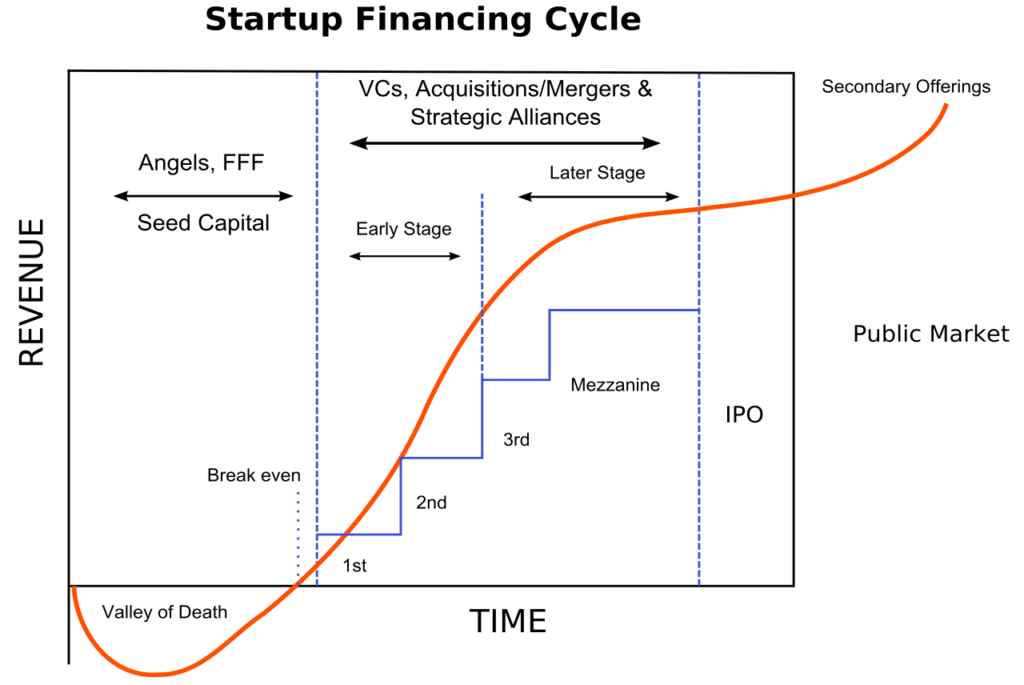

Startup Financing Cycle https://theraise.eu/wp-content/uploads/2023/05/1280px-Startup_financing_cycle.svg_-1024x685.png 1024 685 RAISE fosters startup growth and scale-up within and across Europe RAISE fosters startup growth and scale-up within and across Europe https://theraise.eu/wp-content/uploads/2023/05/1280px-Startup_financing_cycle.svg_-1024x685.pngStarting a business is an exciting and rewarding experience, but it can also be a daunting one, especially when it comes to securing the necessary funding to get your startup off the ground. The process of obtaining funding for a startup typically follows a financing cycle, which includes several stages. In this article, we will explore the various stages of the startup financing cycle and what you need to know as an entrepreneur seeking funding for your business.

Stage 1: Seed Funding

Seed funding is typically the first round of financing that a startup receives. This stage is usually characterized by a small amount of capital raised from family, friends, or angel investors who believe in the potential of the startup. Seed funding is usually used to cover expenses such as product development, market research, and initial overhead costs. At this stage, the startup is often in the idea or concept stage, and investors are investing in the potential of the idea and the team behind it.

Stage 2: Series A Funding

Series A funding is the first significant round of financing that a startup receives after seed funding. It is usually used to build out the team, launch the product or service, and scale the business. This stage is typically characterized by a larger amount of funding, often in the millions of dollars, raised from venture capitalists (VCs) and other institutional investors. At this stage, investors are investing in the company’s potential for growth and revenue generation.

Stage 3: Series B Funding

Series B funding is the next round of financing that a startup receives after Series A funding. This stage is typically characterized by a larger amount of funding than Series A, and is used to further scale the business, build out infrastructure, and expand into new markets. At this stage, the startup is usually generating significant revenue and has proven product-market fit. Investors are investing in the company’s potential for continued growth and revenue generation.

Stage 4: Series C Funding

Series C funding is the next round of financing that a startup receives after Series B funding. This stage is usually characterized by a significant amount of funding, often in the tens or hundreds of millions of dollars, raised from institutional investors, such as hedge funds and private equity firms. At this stage, the startup is usually a mature company with a proven business model, significant revenue, and a large customer base. Investors are investing in the company’s potential for continued growth and market domination.

Stage 5: Initial Public Offering (IPO)

An initial public offering (IPO) is when a private company goes public by selling shares of its stock on a public stock exchange. This stage is typically the final stage in the startup financing cycle, and it allows the company to raise significant capital from public investors. An IPO is usually used to fund further growth and expansion, as well as provide liquidity for early investors and employees. It also provides an exit strategy for early investors and founders who want to sell their shares.

Conclusion

The startup financing cycle can be a long and complex journey, but understanding the different stages and what they entail can help entrepreneurs better prepare for the process. From seed funding to IPO, each stage brings unique challenges and opportunities for growth and expansion. By carefully planning and executing each stage of the financing cycle, startups can successfully navigate the journey from idea to IPO and beyond.

- Posted In:

- Startup News